XBT/USD Analysis: XBT/USD Up-thrust Unstoppable to $8,600? BitMEX Margin Trading

Bitcoin broke out of the descending channel resistance extending the bullish action above $8,300. The current short-term retreat will find support at $8,200, $8,000 and […]

The post XBT/USD Analysis: XBT/USD Up-thrust Unstoppable to $8,600? BitMEX Margin Trading appeared first on Coingape.

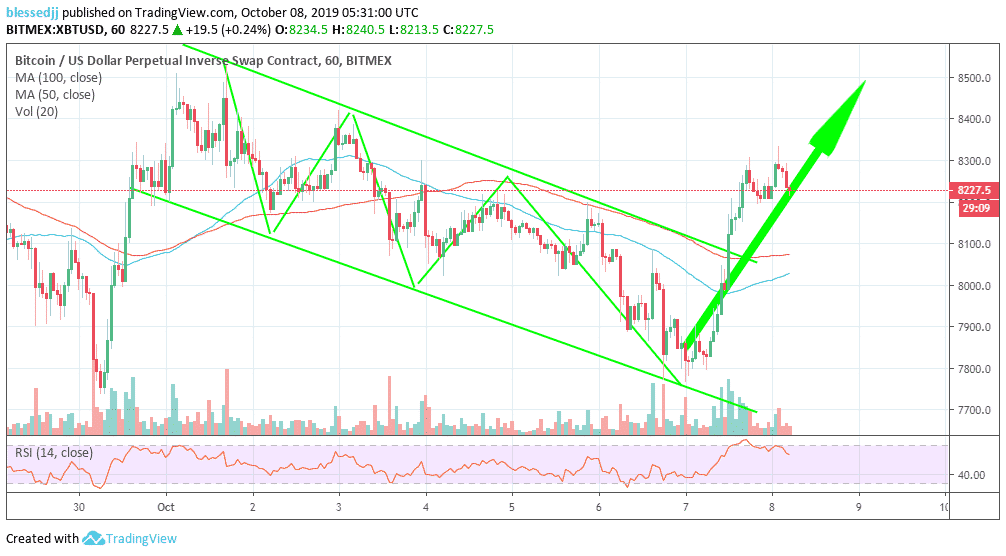

- Bitcoin broke out of the descending channel resistance extending the bullish action above $8,300.

- The current short-term retreat will find support at $8,200, $8,000 and $7,800.

Bitcoin is displaying a bearish picture in the short-term while the long-term timeframe remains strongly bullish. The price on the hourly chart is trading above the moving averages. The 50 MA is inching closer towards the longer-term 100 MA. A double-cross above the long-term moving average is likely to double-down Bitcoin price potential to hit highs above $8,600 and $9,000 respectively.

XBT/USD 1-hour chart

As predicted on Monday, Bitcoin break above the descending resistance gave the price a brilliant boost above $8,000. The successive bullish candlesticks explored the levels above $8,300 but left $8,400 hurdle untested.

At the time of press, XBT/USD is teetering at $8,228 following an ongoing from the weekly high achieved at $8,333. Immediate support is observed at $8,200 while both the 100 MA and the 50 MA will come in handy to cushion losses if the event the reversal extends towards $8,000.

The relative strength index in the same hourly range suggests that the bears are gaining traction in the short-term. The indicator reacted to yesterday’s recovery by hitting levels around 75. However, the current gradual retreat means that the bears have an intent to force action towards $8,000.

Consequently, according to Faibik, a pro analyst on Tradingview the bullish action is far from over. According to the analyst, the daily timeframe has remained bullish with the moving average convergence divergence showing a weakening bearish front and a stronger bullish camp.

XBT key Technical Levels

Spot rate: $8,241

Relative change: 29

Support: $8,000 and $7,800

Resistance: $8,400, $8,600 and $9,000.

Trend: $8,239

The post XBT/USD Analysis: XBT/USD Up-thrust Unstoppable to $8,600? BitMEX Margin Trading appeared first on Coingape.